Seattle Estate Planning Attorney

Compassionate, Experienced Seattle Estate Planning Attorney

- Asset protection

- Healthcare directive

- Long-term care planning

- Your will or a revocable living trust to direct who you leave assets to upon your passing

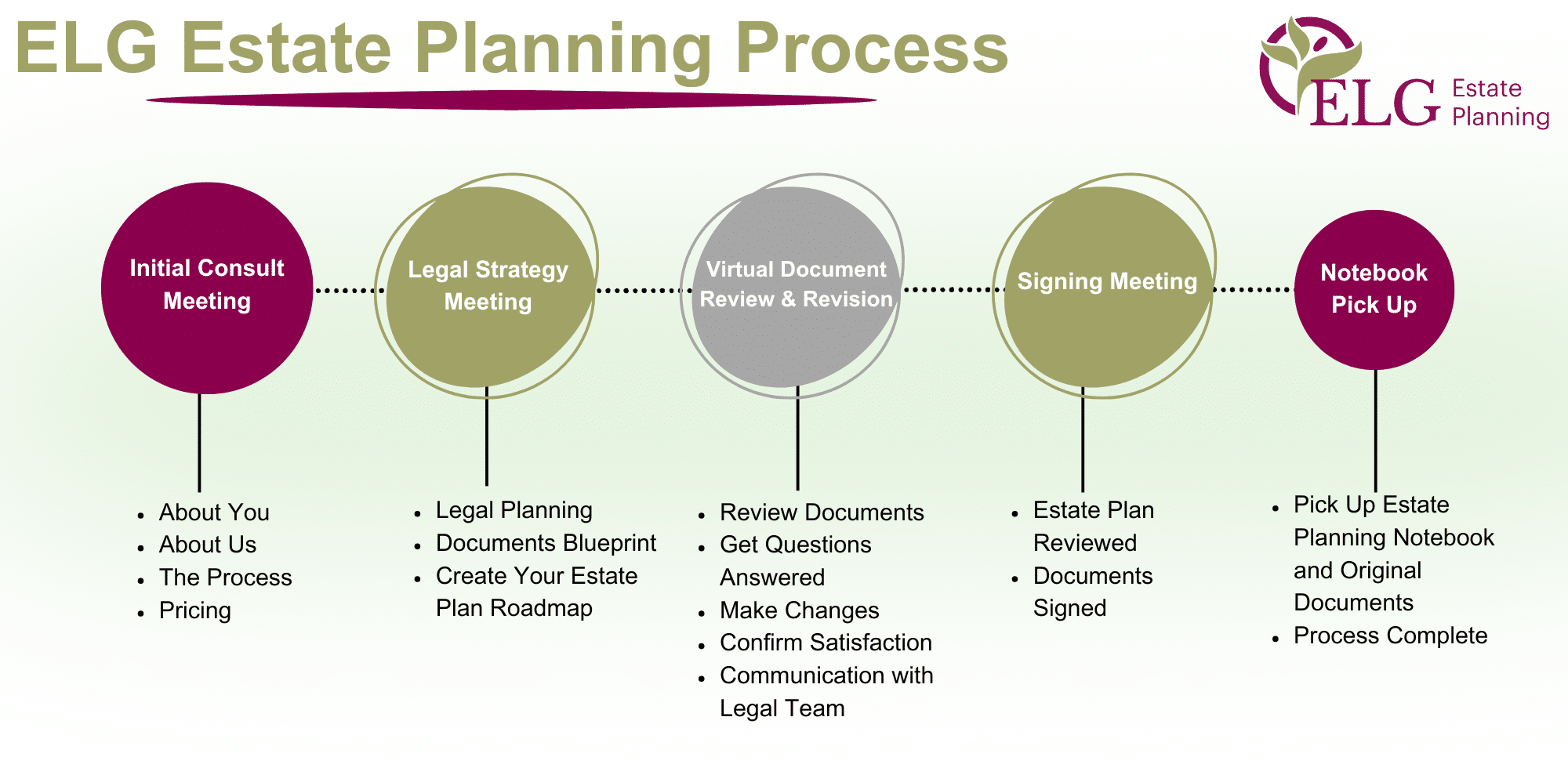

Take a behind-the-scenes look at our ELG Estate Planning Seattle office and meet the incredible team behind the work. From your first consultation to finalizing your plan, we’re here to provide thoughtful guidance every step of the way.

What is an Estate Plan?

- Medical care wishes

- Designation of your Health Care Agent

- Designation of your Financial Agent (Power of Attorney)

- Distribution of your assets on death

Estate plans prevent probate courts from deciding who will inherit your assets based on laws of intestacy – a process that can disrupt families during an already difficult time.

Wills

- Assets

- Guardian rights if you have minor children

Trusts

- Testamentary: You can create an irrevocable trust testamentary trust formed after death. A will often creates a testamentary trust upon a person’s death. These trusts may end when a child reaches a specific age, or they can last for future generations.

- Living Revocable and Irrevocable: A living trust is the most common revocable trust that allows you to manage all of your assets while alive, and upon death, the trust’s beneficiaries will be in control of the assets. You can revoke a revocable living trust at any time. Irrevocable trusts are permanent and are a complete divestment of assets from the trustor to the trustee.

- Special needs: A special needs trust can provide for beneficiaries who receive government benefits or who are disabled. These trusts can help preserve assets for people with special needs without impacting Social Security Income or Medicaid benefits.

Power of Attorneys

Healthcare Directives

Long-Term Care Planning

The costs of Long-Term Care in Seattle can be significant and projections indicate that costs may only continue to rise. Planning is crucial to ensuring that you receive the care you need without expending all your finances.

- Obtain Medicaid to receive Long-Term Care benefits

- Engage in advance planning for your estate, so your plans can change as your circumstances do

How Much Does an Estate Plan Cost?

Why Is an Estate Plan Important?

- Home

- Investments

- Anything of value

- A durable power of attorney

- A healthcare power of attorney

- Advance directive (healthcare directive, also called a “Living Will”

- A trust

- A will

Estate planning can help you avoid these bad outcomes, ensuring that your wishes are carried out if you become incapacitated and after your passing.

A Seattle estate planning attorney can guide you through the process of creating a plan that meets your unique needs and goals.

How To Choose the Best Seattle Estate Planning Attorney Near You for Your Needs

Estate planning is complex, and the impact is significant. It’s important to work with an experienced Seattle estate planning attorney to ensure that your goals and needs are met.

Choosing the right professional is crucial. Here are a few important things to consider:

- Area of focus. Estate planning requires a nuanced approach and the right expertise. An attorney with experience in this area of law will know how to create an estate plan that meets your needs and goals, whether it’s planning for tax minimization, Long-Term Care needs and Medicaid, forming a trust to avoid probate, or to protect beneficiaries and assets.

- Does the attorney answer your questions and explain your options in a way that’s easy to understand? Do they respond in a timely manner? Communication is crucial when working with an estate planning attorney, so it’s important to ensure they meet your expectations.

- Before hiring an attorney, make sure that you understand their fee structure and billing processes so that you know what to expect.

Areas