Tri-Cities Medicaid and Long-Term Care Planning Attorney

You’re not alone. Families who need Medicaid’s long-term care benefits are overwhelmed by the high cost of care and the difficulty of getting Medicaid benefits. You need to meet strict requirements for Medicaid to pay for long-term care, and a Tri-Cities Medicaid planning attorney can help.

We understand how overwhelming it can be to maintain and pay for long-term care costs.

ELG Estate Planning’s founder, Attorney Lynn St. Louis, since 2006 has been helping families navigate the planning process and protect their assets from Medicaid while receiving the long-term care they need to live their best life.

Lynn St. Louis has written the book on Medicaid: How to Protect Your Family’s Assets from Devastating Nursing Home Costs.

We can help if you or a loved one fall into any of the categories below:

- Require immediate long-term care

- Might require long-term care in the future

- Are planning for the future and want to protect assets

HOW CAN SOMEONE PREPARE FOR LONG-TERM CARE COSTS?

Long-term care costs are astronomical, and if someone is turning 65 today, there’s a 70% chance that they’ll require some type of long-term care during their lifetime. You may need:

- At-home care

- Adult family home care

- Assisted living care

- Nursing home facility care

A semi-private room in a nursing home costs $10,000 or more each month, which is an expensive cost that keeps many people up at night.

As your Tri-Cities Medicaid planning attorney, we’re here to provide you with peace of mind that there are options to protect your assets and manage the high costs of care.

You can begin preparing for long-term costs in a few ways:

- Work with a Tri-Cities Medicaid long-term care planning lawyer who can review your income and assets and ensure you have the right estate planning documents in place

- Begin planning ways to strategically transfer assets

- Learn about Medicaid’s long-term care benefits, the five-year lookback period, and ways to avoid spend-down

A robust, well-planned strategy can help you maintain control of key assets without fear of impacting your Medicaid requirements.

If you or a loved one needs immediate care and does not have the luxury of time before costs begin, your best option is to contact an attorney. We can help walk you through the options available and find a way to pay for your care and plan for Medicaid eligibility.

WHY IS MEDICAID PLANNING IMPORTANT?

You may assume that all assets are counted by Medicaid, but there are non-countable resources. For example, let’s say that you have a net worth of $1 million. If your spouse lives in your family house, it is a non-countable asset.

In this case, a $500,000 home would be removed from your net worth.

Working with a Tri-Cities Medicaid planning attorney is advantageous because care facilities may require a private pay period. You may be required to pay for costs for one to three years before Medicaid is accepted.

Of course, this duration can be longer or shorter, especially if care is in a nursing home where there typically is no private pay period.

An attorney can negotiate these terms to the lowest amount possible, so Medicaid will pay for care faster.

If you do have to pay for care costs for before Medicaid is accepted, you may be paying $100,000 – $120,000+ out of pocket for care. Seeking out the help of an attorney can help you:

- Create an estate plan before someone loses capacity

- Take steps to protect your estate’s assets

- Consider if long-term care insurance is an option

- Put tools in place to keep the majority of your assets

Planning is important because it gives you time to take the necessary steps to qualify for Medicaid’s long-term care benefits in advance of the five-year lookback period.

Even in the case of needing immediate care, our attorneys can help you find the best option available to preserve assets and qualify for Medicaid benefits.

What is the Medicaid Five-Year Lookback Period?

When you’re in the midst of Medicaid planning, you’ll hear the term “five-year lookback period” or just “lookback period.” What does this mean?

A five-year lookback period simply means that Medicaid will look back five years from the date of your application to see if you:

- Transferred your assets without compensation

- Gifted assets to family members or others

If you do either of these things, a penalty period will be imposed, and your Medicaid eligibility can be delayed.

In order to qualify for Medicaid, not only do you have to meet the income and asset requirements, but you must also not have transferred or gifted your assets within the five-year lookback period.

For every dollar that you gift or transfer (without compensation), a penalty may be imposed. Depending on your individual circumstances, the penalty period may be significant.

ELG Estate Planning can help you avoid this penalty by planning for this lookback period now while you are still in good health. If you are in need of care now and five year planning is not an option, we can still assist you and help you find the optimal solution for your family.

WHAT ARE MEDICAID ASSET PRESERVATION STRATEGIES® (MAPS®)?

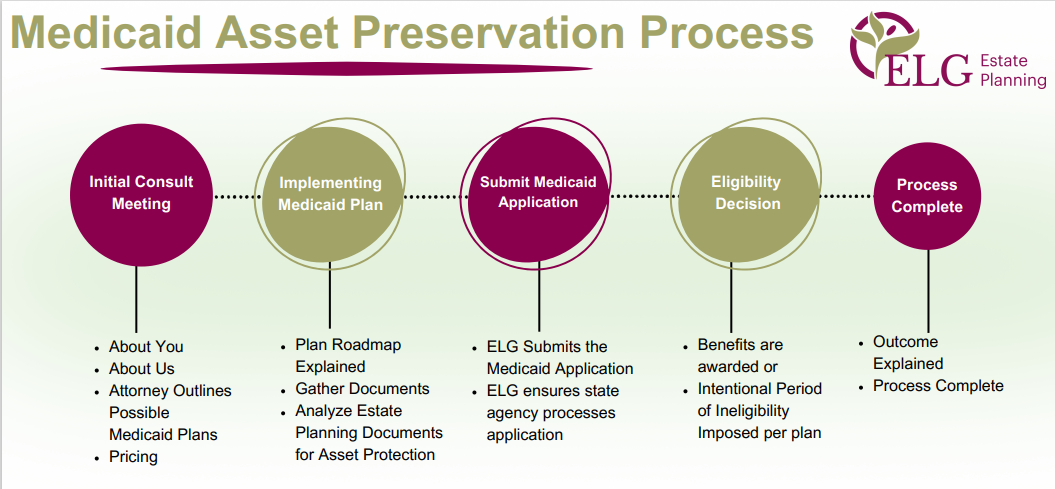

Medicaid Asset Preservation Strategies®, or MAPS®, are methods an ELG Tri-Cities Medicaid planning attorney can use to help you protect your assets while still ensuring that you qualify for Medicaid.

Medicaid’s rules are complex, and they are constantly changing. At ELG, our experienced Tri-Cities elder law attorneys, who understand Medicaid, can employ MAPS® to help:

- Prevent you from having to spend all of your money just to qualify for benefits

- Protect your family home from estate recovery, so you can pass it down to your children after your death

- Ensure the well spouse is not impoverished while the spouse in need receives care

There are several strategies that we can use to protect your hard-earned assets while preparing for Medicaid eligibility. The sooner we can start planning, the better.

What are Common Medicaid Asset Preservation Strategies® (MAPS®)?

Common Medicaid Asset Preservation Strategies® can include:

- Spend-down strategies. For example, you might pay off outstanding debts, purchase medical equipment you need that isn’t covered by insurance, or purchase Medicaid Compliant Annuities at the time of need.

- Form a Medicaid Asset Protection Trust, which transfers ownership of assets to the Trust. Either Medicaid’s lookback period or a penalty may apply. It’s best to plan in advance, though time of need strategies are available.

- Long-term care insurance, which can help cover the cost of care while protecting your assets.

ELG’s Tri-Cities Medicaid long-term care planning lawyer can help you understand your options and which MAPS® will be most effective for your unique situation.

IS IT TOO LATE TO HIRE A MEDICAID AND LONG-TERM CARE PLANNING LAWYER TO HELP MY FAMILY?

No matter what stage of life you are in or whether you need care now or in the future, it is never too late to hire a Tri-Cities Medicaid planning attorney.

At ELG Estate Planning, our capable attorneys can assist with Medicaid Asset Preservation Strategies®, including Medicaid crisis planning.

The need for care can be unexpected. If you or a loved one needs care immediately, crisis planning can help you get the care you need and work towards Medicaid eligibility.

If you’re in good health, we can begin implementing strategies now to help ensure that you qualify for Medicaid benefits if the need for long-term care should arise.

Contact ELG Estate Planning today to schedule a consultation. From our Kennewick office we serve the Tri-Cities: Kennewick, Pasco, Richland, and West Richland and other nearby areas.